Last updated on: March 8th, 2024

Legal Sports Betting Revenue Tracker – Sportsbook Revenue By State

As state gaming commissions release their monthly reports, we keep track of the US sportsbook revenue by state. Helpful to predict future industry numbers, this legal sports betting revenue tracker offers a view into the multi-billion-dollar industry.

- The states with sports betting have different methods for distributing data. But this page is updated as needed to consolidate the data for the ease of understanding.

Don’t leave making money just up to the sportsbooks. Earn your winnings with tournaments at Bovada. And we’re not talking about ]poker or the casino, even though they have those too. Bovada’s NFL Tournament odds and March Madness brackets make betting fun. Play against people from all over the world and find yourself taking money from the book.

- Exclusive Bonus Code

- 50% up to $1000

- Use code BVD1000 in Cashier

Sports Betting Revenue By State

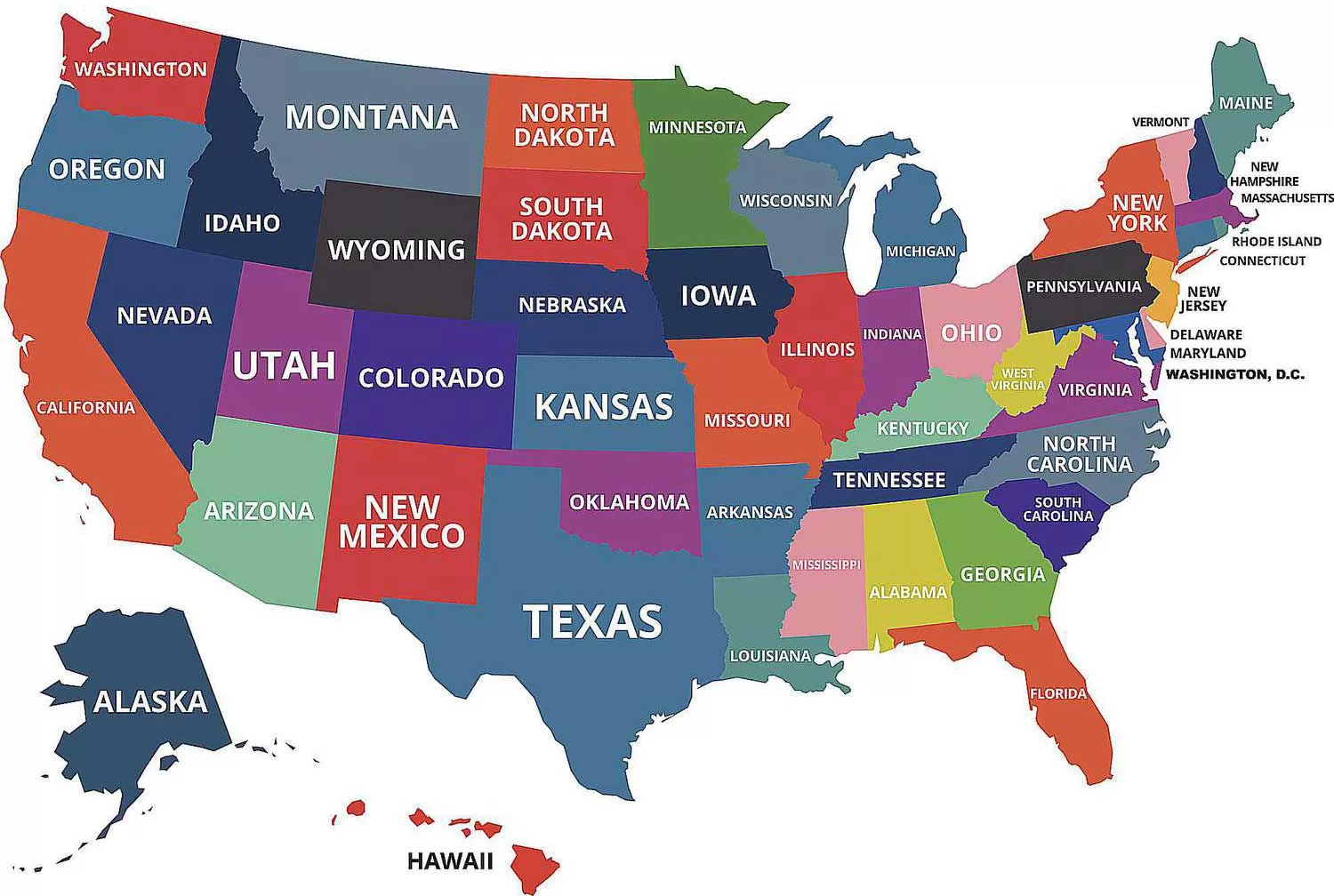

Regulated sports betting exists in almost 40 states. This means sports betting revenue is everywhere. At LegalSportsBetting, revenue reports give us a look into legal sports betting finances. All numbers come from the gaming commissions’ revenue reports.

- Keep in mind that the first year for each state may not represent an entire calendar year.

- Some 2023 numbers are incomplete, as we await the final one or two monthly reports from gaming commissions.

- Nevada’s 2018 data starts in June – the first full month after the repeal of PASPA.

Nevada

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $3,021,298,706 | $193,929,000 | 6.419% | $13,090,209 |

| 2019 | $5,318,922,640 | $329,037,000 | 6.186% | $22,210,000 |

| 2020 | $4,339,486,867 | $262,800,000 | 6.056% | $17,739,004 |

| 2021 | $8,147,648,361 | $445,116,000 | 5.463% | $30,045,332 |

| 2022 | $8,633,518,183 | $449,071,000 | 5.201% | $30,312,296 |

| 2023 | $7,417,452,705 | $422,307,000 | 5.693% | $28,505,726 |

New Jersey

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $1,247,307,720 | $94,022,393 | 7.538% | $11,601,261 |

| 2019 | $4,582,898,150 | $299,398,035 | 6.533% | $40,268,621 |

| 2020 | $6,012,531,987 | $398,231,302 | 6.623% | $54,982,359 |

| 2021 | $10,927,585,885 | $814,981,641 | 7.458% | $112,736,461 |

| 2022 | $10,944,593,978 | $762,954,971 | 6.971% | $107,425,899 |

| 2023 | $11,972,320,289 | $1,006,681,602 | 8.408% | $141,517,468 |

Arizona

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $1,743,249,640 | $161,057,784 | 9.239% | $5,955,284 |

| 2022 | $6,036,844,930 | $482,932,555 | 8.000% | $28,914,694 |

| 2023 | $5,166,902,608 | $447,385,347 | 8.659% | $27,977,327 |

Mississippi

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $158,565,586 | $15,175,667 | 9.571% | $1,821,080 |

| 2019 | $369,173,582 | $44,451,371 | 12.041% | $5,334,165 |

| 2020 | $363,775,649 | $43,741,530 | 12.024% | $5,248,985 |

| 2021 | $586,086,026 | $65,868,088 | 11.239% | $7,904,172 |

| 2022 | $531,585,628 | $60,739,616 | 11.426% | $7,288,754 |

| 2023 | $425,387,043 | $46,337,369 | 10.893% | $5,560,485 |

West Virginia

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $47,796,234 | $6,623,563 | 13.858% | $662,356 |

| 2019 | $228,285,426 | $19,434,393 | 8.513% | $1,945,349 |

| 2020 | $400,741,355 | $27,286,723 | 6.809% | $2,728,673 |

| 2021 | $546,940,861 | $45,127,957 | 8.251% | $4,512,797 |

| 2022 | $571,317,850 | $50,822,381 | 8.896% | $5,082,238 |

| 2023 | $429,218,366 | $41,406,171 | 9.647% | $4,140,618 |

Pennsylvania

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $47,796,234 | $6,623,563 | 13.858% | $662,356 |

| 2019 | $228,285,426 | $19,434,393 | 8.513% | $1,945,349 |

| 2020 | $400,741,355 | $27,286,723 | 6.809% | $2,728,673 |

| 2021 | $546,940,861 | $45,127,957 | 8.251% | $4,512,797 |

| 2022 | $571,317,850 | $50,822,381 | 8.896% | $5,082,238 |

| 2023 | $429,218,366 | $41,406,171 | 9.647% | $4,140,618 |

Rhode Island

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $13,770,713 | $1,030,910 | 7.486% | $525,764 |

| 2019 | $245,811,496 | $17,806,694 | 7.244% | $9,081,413 |

| 2020 | $221,916,076 | $24,067,477 | 10.845% | $12,274,413 |

| 2021 | $454,457,990 | $38,751,495 | 8.527% | $19,763,261 |

| 2022 | $532,609,814 | $49,298,062 | 9.256% | $25,142,012 |

| 2023 | $365,101,422 | $32,717,606 | 8.961% | $16,685,978 |

Arkansas

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $13,770,713 | $1,030,910 | 7.486% | $525,764 |

| 2019 | $245,811,496 | $17,806,694 | 7.244% | $9,081,413 |

| 2020 | $221,916,076 | $24,067,477 | 10.845% | $12,274,413 |

| 2021 | $454,457,990 | $38,751,495 | 8.527% | $19,763,261 |

| 2022 | $532,609,814 | $49,298,062 | 9.256% | $25,142,012 |

| 2023 | $365,101,422 | $32,717,606 | 8.961% | $16,685,978 |

New York

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $67,960,787 | $7,783,423 | 11.453% | $778,343 |

| 2020 | $98,109,146 | $10,768,728 | 10.976% | $1,076,872 |

| 2021 | $197,476,663 | $23,321,149 | 11.810% | $2,332,112 |

| 2022 | $16,288,073,156 | $1,367,052,768 | 8.393% | $693,923,018 |

| 2023 | $19,196,867,479 | $1,697,297,617 | 8.842% | $862,582,466 |

Iowa

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $212,225,668 | $19,283,690 | 9.086% | $1,301,649 |

| 2020 | $575,248,472 | $41,623,877 | 7.236% | $2,809,753 |

| 2021 | $2,053,708,513 | $125,512,412 | 6.112% | $8,472,088 |

| 2022 | $2,348,065,964 | $165,551,990 | 7.051% | $11,174,759 |

| 2023 | $2,420,464,385 | $199,027,690 | 8.223% | $13,434,370 |

Oregon

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $45,272,116 | $2,924,340 | 6.459% | $1,462,171 |

| 2020 | $218,246,341 | $20,072,419 | 9.197% | $10,036,212 |

| 2021 | $331,599,514 | $30,398,008 | 9.167% | $15,199,008 |

| 2022 | $497,985,675 | $49,519,353 | 9.944% | $24,759,680 |

| 2023 | $601,820,650 | $65,963,483 | 10.961% | $32,981,744 |

Indiana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $435,996,520 | $41,576,946 | 9.536% | $3,931,772 |

| 2020 | $1,769,270,606 | $136,395,416 | 7.709% | $13,165,417 |

| 2021 | $3,829,411,987 | $308,304,353 | 8.051% | $29,089,084 |

| 2022 | $4,467,882,215 | $386,888,311 | 8.659% | $36,797,945 |

| 2023 | $4,337,817,508 | $404,363,766 | 9.322% | $38,417,065 |

Montana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $18,770,480 | $2,368,463 | 12.618% | $294,849 |

| 2021 | $47,215,732 | $6,406,223 | 13.568% | $1,010,790 |

| 2022 | $50,918,515 | $7,173,449 | 14.088% | $1,248,959 |

| 2023 | $62,258,820 | $8,446,611 | 13.567% | $1,332,437 |

Louisiana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $67,388,583 | $10,066,406 | 14.938% | $1,006,641 |

| 2022 | $2,302,509,284 | $215,680,964 | 9.367% | $34,205,762 |

| 2023 | $2,528,091,484 | $310,789,087 | 12.293% | $35,876,138 |

Tennessee

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $312,344,523 | $27,124,908 | 8.684% | $5,443,918 |

| 2021 | $2,730,459,000 | $239,872,000 | 8.785% | $39,300,000 |

| 2022 | $3,850,547,906 | $379,409,891 | 9.853% | $68,052,961 |

| 2023 | $4,292,352,235 | $451,028,296 | 10.508% | $83,557,513 |

Maryland

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $16,552,430 | $3,170,001 | 19.151% | $469,297 |

| 2022 | $979,584,836 | $149,480,586 | 15.260% | $6,100,504 |

| 2023 | $4,617,323,134 | $514,081,188 | 11.134% | $46,165,906 |

Virginia

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $3,221,790,714 | $285,895,559 | 8.874% | $20,340,023 |

| 2022 | $4,914,954,449 | $481,233,605 | 9.791% | $51,765,686 |

| 2023 | $4,315,837,488 | $453,263,732 | 10.502% | $58,350,376 |

New Hampshire

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $3,221,790,714 | $285,895,559 | 8.874% | $20,340,023 |

| 2022 | $4,914,954,449 | $481,233,605 | 9.791% | $51,765,686 |

| 2023 | $4,315,837,488 | $453,263,732 | 10.502% | $58,350,376 |

Connecticut

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $336,444,408 | $33,267,269 | 9.888% | $3,154,423 |

| 2022 | $1,519,890,754 | $145,306,247 | 9.560% | $14,525,092 |

| 2023 | $1,550,846,647 | $159,435,590 | 10.281% | $16,967,075 |

South Dakota

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $2,651,489 | $254,582 | 9.601% | $22,913 |

| 2022 | $7,192,829 | $1,046,997 | 14.556% | $94,229 |

| 2023 | $7,890,753 | $855,833 | 10.846% | $77,026 |

Washington DC

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $2,651,489 | $254,582 | 9.601% | $22,913 |

| 2022 | $7,192,829 | $1,046,997 | 14.556% | $94,229 |

| 2023 | $7,890,753 | $855,833 | 10.846% | $77,026 |

Michigan

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $130,763,498 | $18,276,857 | 13.977% | $1,535,256 |

| 2021 | $3,965,906,303 | $319,522,216 | 8.057% | $13,612,812 |

| 2022 | $4,814,088,969 | $418,647,137 | 8.696% | $22,059,404 |

| 2023 | $4,197,478,178 | $368,517,713 | 8.780% | $19,450,529 |

Wyoming

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $40,348,146 | $4,012,816 | 9.945% | $111,914 |

| 2022 | $144,522,130 | $14,787,230 | 10.232% | $843,171 |

| 2023 | $153,223,568 | $15,444,324 | 10.080% | $922,831 |

Colorado

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $1,185,754,618 | $75,841,207 | 6.396% | $2,965,322 |

| 2021 | $3,847,527,102 | $250,048,945 | 6.499% | $11,701,499 |

| 2022 | $5,181,758,903 | $351,950,255 | 6.792% | $19,634,715 |

| 2023 | $4,235,313,749 | $322,823,162 | 7.622% | $22,251,879 |

Illinois

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $1,882,620,542 | $137,410,656 | 7.299% | $20,191,143 |

| 2021 | $7,021,763,064 | $534,086,819 | 7.606% | $84,691,181 |

| 2022 | $9,751,301,251 | $806,195,859 | 8.268% | $127,668,464 |

| 2023 | $8,931,018,896 | $809,684,491 | 9.066% | $128,816,132 |

All States

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2022 | $4,506,326,636 | $313,298,122 | 6.952% | $28,606,642 |

| 2023 | $13,008,349,237 | $894,803,020 | 6.879% | $116,787,191 |

| 2024 | $21,516,361,612 | $1,537,352,103 | 7.145% | $233,351,369 |

| 2025 | $57,643,256,951 | $4,329,879,307 | 7.512% | $561,385,988 |

| 2026 | $92,914,954,162 | $7,501,015,109 | 8.073% | $1,501,155,758 |

| 2027 | $95,231,336,904 | $8,486,914,348 | 8.912% | $1,765,960,341 |

States With Most Tax Revenue

| State | Tax Revenue | Tax % |

|---|---|---|

| New York | $1,560,692,815 | 51% |

| Pennsylvania | $505,353,064 | 36% |

| New Jersey | $468,532,070 | 8.5% |

| Illinois | $361,366,919 | 15% |